TRX Price Prediction: Bullish Technicals and Positive Catalysts Signal Investment Potential

#TRX

- TRX trading above 20-day moving average indicates bullish technical momentum

- MACD positive crossover suggests emerging upward price potential

- Regulatory developments and ecosystem expansion provide fundamental support

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

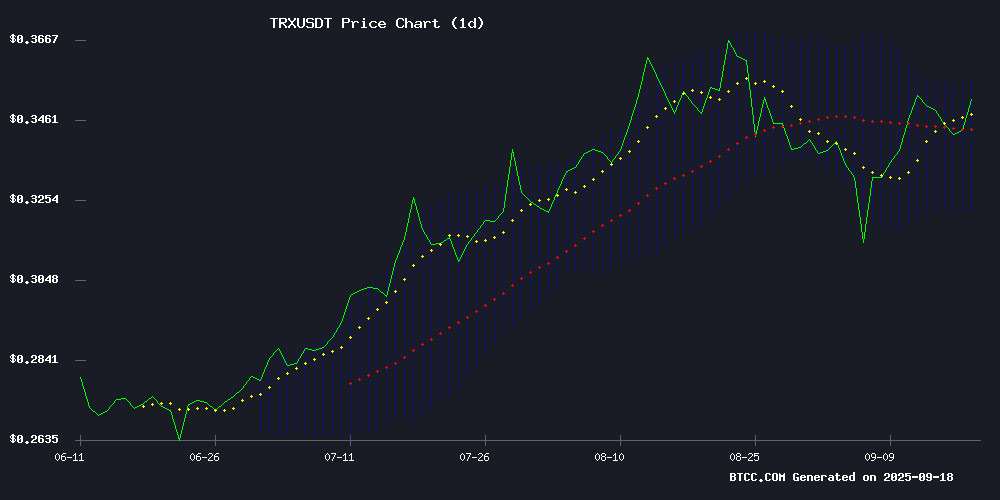

TRX is currently trading at $0.3443, positioned above its 20-day moving average of $0.3392, indicating underlying strength. The MACD reading of 0.000224 suggests emerging bullish momentum, though the negative histogram (-0.004396) warrants caution for near-term volatility. Price action remains within Bollinger Bands ($0.3227-$0.3557), with current levels approaching the upper band, potentially signaling overbought conditions. According to BTCC financial analyst Sophia, 'TRX's position above the 20-day MA combined with positive MACD momentum suggests potential for continued upward movement, though traders should monitor resistance at the upper Bollinger Band.'

Market Sentiment Boosted by Regulatory Developments and Ecosystem Expansion

Recent developments are creating favorable conditions for TRX and broader cryptocurrency markets. The SEC's streamlined approval process for spot crypto ETFs enhances institutional accessibility, while PACT SWAP's cross-chain integration with Dogecoin and Polygon improves interoperability and utility. TRON's stablecoin growth and BlockchainFX presale surge demonstrate robust ecosystem development. BTCC financial analyst Sophia notes, 'These developments collectively create a supportive backdrop for TRX, with regulatory clarity and expanding use cases driving positive market sentiment that complements the technical bullish signals.'

Factors Influencing TRX's Price

SEC Streamlines Approval Process for Spot Crypto ETFs

The U.S. Securities and Exchange Commission has introduced new listing standards that significantly ease the path for spot cryptocurrency ETFs. Under the updated rules, cryptocurrencies with listed futures on Coinbase—approximately 12 to 15 assets—will automatically qualify for inclusion, eliminating the need for individual case-by-case approvals.

This regulatory shift reduces bureaucratic friction and accelerates market access for spot crypto ETFs, marking a pivotal moment for institutional adoption. The decision reflects growing recognition of digital assets as a legitimate investment class within traditional finance frameworks.

PACT SWAP Expands Cross-Chain Trading with Dogecoin and Polygon Integration

PACT SWAP, a bridgeless cross-chain decentralized exchange, has added support for Dogecoin (DOGE) and Polygon (POL), bringing its total supported networks to seven. The platform now enables native swaps across Bitcoin, Ethereum, BNB Chain, Litecoin, TRON, Dogecoin, and Polygon without relying on wrapped assets or bridges.

Stephen Morris, CEO of PACT SWAP Labs, emphasized the project's mission to rival centralized exchanges in pair breadth and pricing while maintaining decentralization. Sandeep Nailwal, Co-Founder of Polygon, highlighted the significance of cross-chain liquidity for mainstream adoption, noting PACT SWAP's role in reducing user complexity and risk.

TRON Stablecoin Growth and BlockchainFX Presale Surge Highlight Crypto Market Dynamics

TRON's dominance in stablecoin transactions and Avalanche's DeFi innovations are being overshadowed by the explosive presale performance of BlockchainFX ($BFX). The token, already generating daily rewards at 90% APY, has seen its presale price surge from $0.01 to $0.024 ahead of a planned $0.05 launch. Over $7.5 million has been raised from nearly 10,000 participants.

BlockchainFX distinguishes itself through real utility—a live trading platform combining crypto with traditional assets, audited by CertiK. Early adopters report 4-7% daily returns from fee redistribution in USDT, with additional perks like Visa card integration driving demand. Market parallels are being drawn to Ethereum and Solana's early days, as investors scramble for position before the next price hike.

Is TRX a good investment?

Based on current technical indicators and market developments, TRX presents a compelling investment opportunity. The cryptocurrency is trading above its 20-day moving average with emerging bullish MACD momentum, while recent news around ETF approvals and ecosystem expansion provides fundamental support.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.3443 | Above 20-day MA |

| 20-day MA | $0.3392 | Support Level |

| MACD | 0.000224 | Bullish Crossover |

| Bollinger Upper | $0.3557 | Near-term Resistance |

| Bollinger Lower | $0.3227 | Support Level |

BTCC financial analyst Sophia suggests that while technical indicators are positive, investors should consider their risk tolerance and monitor key resistance levels, particularly the upper Bollinger Band at $0.3557.